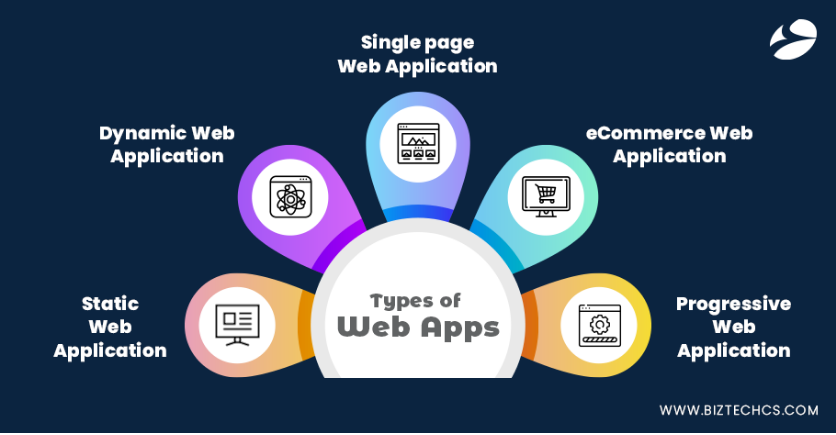

The world of finance is evolving rapidly, driven by the integration of innovative technologies that have redefined how financial services are delivered. Organizations increasingly seek fintech solutions to streamline operations, enhance customer experiences, and drive profitability as the finance industry grows more competitive. With the rise of digital transformation, financial services must adapt or risk falling behind. But how exactly can fintech solutions revolutionize the finance industry, and what role do Finance Industry IT Solutions play in this transformation?

In this article, we’ll explore how fintech reshapes financial services and how adopting the right digital solutions can provide significant advantages for businesses and their customers.

1. Improved Customer Experience with Digital Services

One of the most profound changes fintech solutions have brought to the finance industry is customer experience transformation. In an age where consumers expect instant, seamless interactions, financial services must offer the same level of convenience that tech-savvy platforms like Amazon or Netflix provide.

How It Transforms Customer Experience:

Mobile Banking & Apps: Fintech solutions enable financial institutions to offer mobile-first experiences, giving customers access to their accounts, transactions, and financial planning tools anytime, anywhere. This has resulted in a more engaged customer base, particularly among millennials and younger generations.

Personalized Services: With AI and machine learning, fintech solutions can offer personalized recommendations and tailored financial products based on customer data. These technologies allow banks to understand individual customer needs and provide targeted solutions—be it investment advice, savings programs, or loan offers.

2. Faster and More Secure Transactions

Traditional financial services often suffer from delays and inefficiencies in processing transactions, especially cross-border payments. However, fintech innovations are streamlining these processes, making transactions faster, cheaper, and more secure.

How It Transforms Transactions:

Blockchain and Cryptocurrencies: Blockchain technology has made significant strides in finance by providing a secure, transparent way to conduct transactions. For cross-border payments, blockchain eliminates the need for intermediaries, significantly reducing transaction costs and time. Cryptocurrencies, like Bitcoin and Ethereum, are also becoming more widely accepted, further pushing the boundaries of traditional payment methods.

Real-time Payments: Fintech solutions like mobile wallets, peer-to-peer (P2P) payment systems (e.g., Venmo, PayPal), and instant bank transfers ensure real-time money movement, making payments more efficient and timely for businesses and consumers.

3. Increased Efficiency Through Automation

The finance industry has long been burdened with time-consuming manual processes and paperwork. Fintech solutions transform back-office operations by automating routine tasks, such as loan approvals, compliance checks, and customer onboarding.

How It Transforms Efficiency:

Robotic Process Automation (RPA): RPA in the finance sector automates repetitive tasks like data entry, invoice processing, and reporting. This reduces human error, cuts operational costs, and frees staff to focus on more strategic activities.

AI-Powered Risk Assessment: Artificial intelligence helps financial institutions assess credit risk more efficiently. AI algorithms can analyze vast data points (from transaction history to social media activity) to predict the likelihood of loan default, improving the loan approval process and reducing risk.

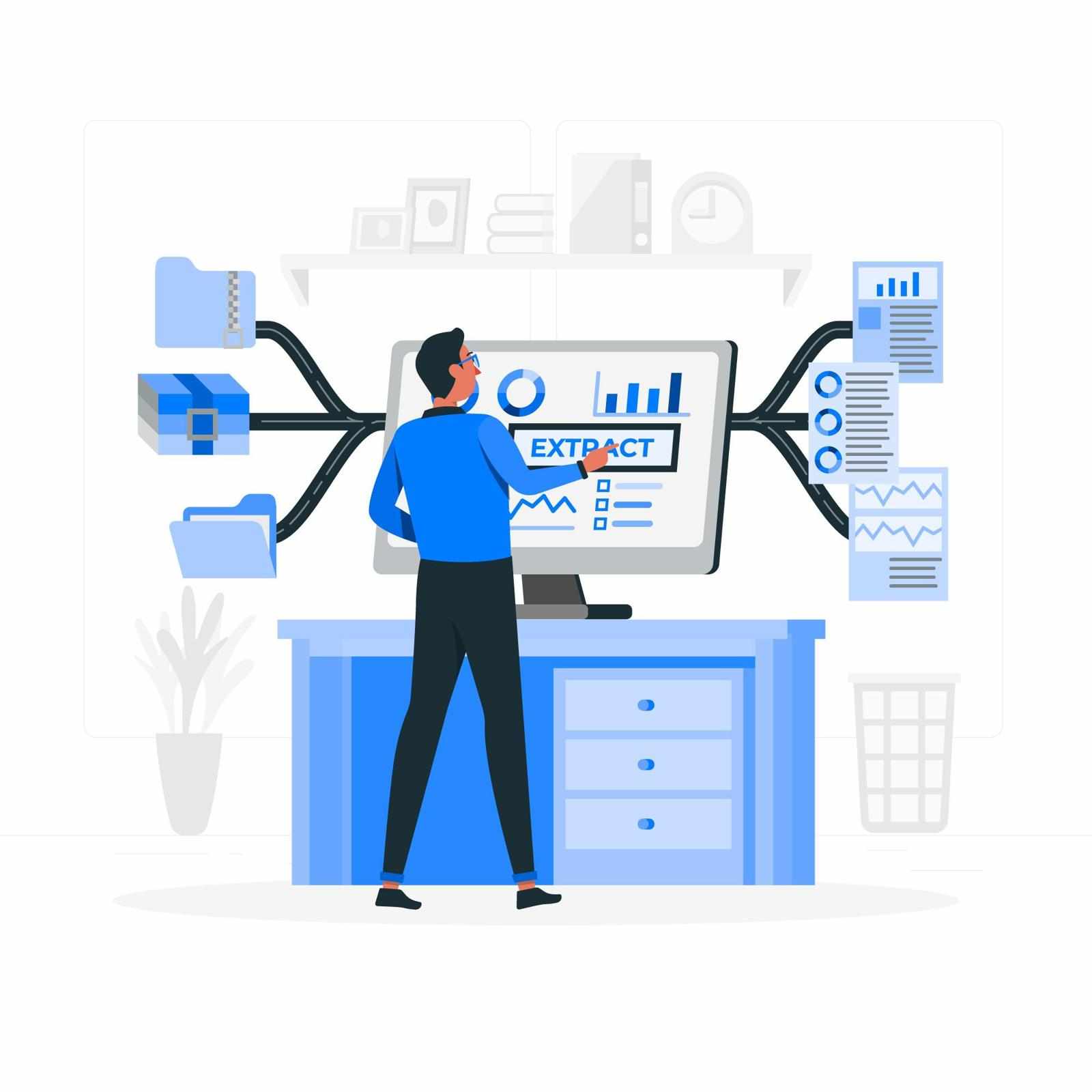

4. Enhanced Data Analytics for Smarter Decision-Making

Data is the lifeblood of the modern financial services industry, and fintech solutions are equipped with powerful tools to help financial institutions leverage that data for more intelligent decision-making. With better access to data analytics, businesses can make informed, real-time decisions that drive business growth and improve customer outcomes.

How It Transforms Decision-Making:

Predictive Analytics: By analyzing vast datasets, fintech platforms can predict market trends, consumer behavior, and potential risks. This helps organizations make data-driven decisions about product offerings, pricing strategies, and investment opportunities.

Customer Insights: Advanced analytics provide a deeper understanding of customer preferences, behaviors, and needs. This enables financial institutions to create more relevant, targeted products and services, enhancing customer satisfaction and loyalty.

5. Cost Reduction and Scalability

Adopting fintech solutions improves efficiency and can help reduce operational costs and scale services with minimal effort. As businesses expand, fintech solutions can grow with them, eliminating the need for costly infrastructure upgrades.

How It Transforms Cost Management:

Cloud-Based Solutions: Many fintech services are cloud-based, allowing financial institutions to scale without expensive hardware or IT infrastructure. This reduces upfront investment and ensures that organizations only pay for the resources they use.

Cost-Efficient Payments: Fintech solutions streamline payment processing, eliminating hidden fees and high charges associated with traditional banking. Peer-to-peer payment systems and digital wallets can reduce fees, making it easier for businesses and customers to complete transactions cost-effectively.

Conclusion: The Future of Financial Services Is Fintech

In 2025, the role of fintech solutions in the finance industry is more critical than ever. By embracing these technologies, financial institutions can enhance customer experience, streamline operations, improve decision-making, reduce costs and ensure compliance. The right Finance Industry IT Solutions are essential in driving digital transformation and positioning businesses to thrive in an increasingly competitive landscape.

Write a comment ...